Retrenchment package calculator

bleach 125. rész 14 napos időjárás előrejelzés debrecenHow to Calculate Severance Pay: A Step-by-Step Guide - wikiHow. The severance calculator provides the user with an estimate of an employees severance benefits using the employees salary, length of service, and other characteristics retrenchment package calculator. It is …. Employee Retrenchment Benefit Calculator - Low & Partners retrenchment package calculator. Employee Retrenchment Benefit Calculator. There is so much of confusion when comes to the calculation of “Retrenchment Benefit” & notice required if the employer decides …. How to calculate severance pay due to employees … retrenchment package calculator. The starting point to calculate the employee’s severance pay will be to understand sections 35 and 41 of the Basic Conditions of Employment (BCEA) retrenchment package calculatorمسلسل رشاش 8 800 лир в тенге

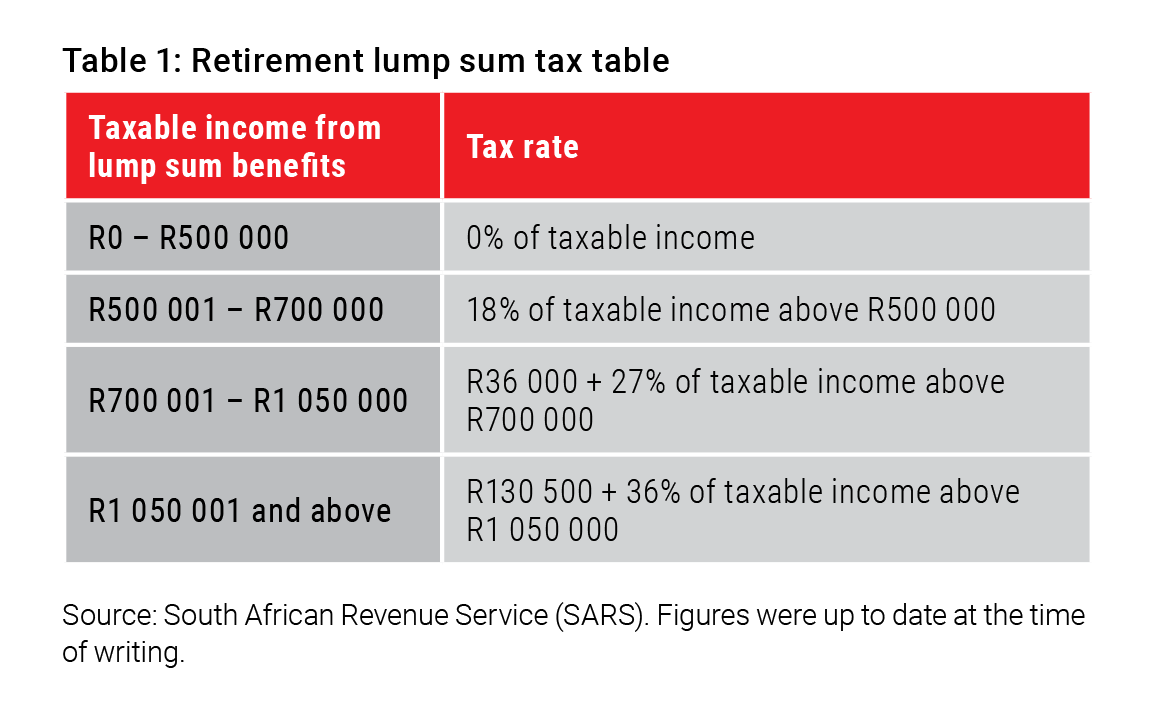

. These sections were supplemented by a notice published in the … retrenchment package calculator. Online Severance Calculator - Severance Pay Calculator - Hyde …. Hyde HR Law Severance Calculator retrenchment package calculator. See how much severance you could be entitled to! Please indicate which one of the following roles applies to you. ABOUT US. Hyde HR … retrenchment package calculator. Severance Pay - SME Labour Support by CCMA and Busa. The one week’s severance pay per completed year of continuous service is the minimum amount the employer must pay by law. This is based on the gross (before tax) …. Retrenchment benefits and packages in South Africa. R500 001 – R700 000. R700 001 – R1 050 000 retrenchment package calculator. R1 050 001 and above. 0% of benefit. 18% of benefit over R500k. R36,000 + 27% of benefit over R700k. R130,500 + 36% of benefit over R1,050k. Therefore, if you have …. How Do You Calculate Retrenchment Package | Interesting … retrenchment package calculatorcum sa faci live pe twich uganda police transfers today

. Retrenchment packages must be put in writing and discussed in private with each affected employee. However, in working out severance packages, Section 41 and Section 35 of …. What Is Severance Pay, And How Do I Calculate It? - SEESA. A retrenchment is thus seen as a “no-fault” dismissal. A severance package is calculated and paid to the affected employee to compensate for their loss of …. The right way to handle retrenchments | Labour Research …. The following payments are included in an employee’s remuneration to calculate severance pay, according to the determination issued by the Minister of …. Redundancy pay and entitlements - Fair Work Ombudsman. Reducing redundancy pay. An employer can apply to the Fair Work Commission (FWC) to have the amount of redundancy pay reduced if: the employer finds other acceptable …. Retrenchments - Back to Basics - Labour Guide South Africa. We have been given a “voluntary retrenchment” agreement for those of us that would prefer to take advantage of the retrenchment package that is offered if we …. What is Retrenchment Compensation | Eligibility and How it Works retrenchment package calculator. Components of Calculation

cuaca besok di kampar ysq international

. How is a retrenchment package calculated in Zimbabwe?. How much tax do you pay on retrenchment package? As the severance benefit and retrenchment cash lump sum benefits are taxed according to the retirement …. Tax and Retrenchment | South African Revenue Service - SARS retrenchment package calculator. When you are retrenched, your employer may pay you a lump sum for the termination of your services, and this lump sum may qualify as a severance benefit. From 1 March 2011, special tax rates applicable to severance benefits were implemented, where the first R315,000 of the severance benefit was not subject to tax.. How Do You Calculate Retrenchment Package | Interesting … retrenchment package calculator. Retrenchment packages must be put in writing and discussed in private with each affected employee retrenchment package calculator. However, in working out severance packages, Section 41 and Section 35 of the Basic Conditions of Employment Act must be read in conjunction with one another. Section 35 lays down the exact criteria for calculating the legally correct package.

cand se fac nunti in 2020 cfare shkakton rrotullimi i tokes rreth diellit

. 36,000 + 27% of taxable income above 700,000. retrenchment package calculator. Employees Retrenchment | Jabatan Tenaga Kerja Semenanjung …. The Employment Retrenchment Notification 2004 (Borang PK) has been gazetted as P.U (B) retrenchment package calculator. Employees are entitled to receive written termination benefits amount and its calculation method. Termination benefits must be paid no later than 7 days from termination date. A termination benefit calculation calculator is available at the Calculator menu.. How are you taxed on your retrenchment package? | JustMoneysa plug wiring ランバラル 名言

. JustMoney looks at the various components of a retrenchment package, and how these are taxed. Tip: Calculate how much you’ll take home after tax by using our tax calculator. Severance pay. According to the South African Revenue Service (SARS), the amount of tax you pay on your severance depends on the payout you receive and …. 2022 Malaysia Retrenchment Benefits Calculator - Fincrew. For LOE starting from 1st January 2021 until 30th June 2022, click HERE to calculate your benefitcontagio de hiv por saliva მარტინი

. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions (CQC) i.e retrenchment package calculator. the number of monthly contributions you have paid before. Benefit Calculator (SIP) Wagebialka tatrzanska időjárás nurdian cuaca net worth

. (Enter an amount). NEW: Amended labour law to increase retrenchment packages. Under the current law, a person who worked for a company for 10 years will get five months worth of pay as their retrenchment package, which members of the public said was too little. “In this regard, a proposal was made to make the retrenchment package three months’ pay for each year of completed service retrenchment package calculator. “Further suggestions from the .. What is Retrenchment Compensation | Eligibility and How it Works. Components of Calculation. Retrenchment compensation calculation is calculated keeping in mind the allowances such as basic wages, dearness allowance (DA), all attendance attendees, house rent allowance, conveyance etc retrenchment package calculator. Additionally, the value of housing and amenities have given according to the housing should be considered. …. Retrenchment benefits | LifeSG – Guides retrenchment package calculator. The amount of retrenchment benefits follows the employment contract or the collective agreement for unionised companies. You will usually get 2 weeks to 1 month salary for each year of service, depending on the company’s financial position and the industry. For unionised companies, the norm is 1 month’s salary for each year of service.. Retrenchment Process and Procedure | QuickLaw Guide. Retrenchment is a form of dismissal due to no fault of the employee, it is a process whereby the employer reviews its business needs in order to increase profits or limit losses, which leads to reducing its employees retrenchment package calculator. The employer must give fair reasons for making the decision to retrench and follow a fair procedure when making such a decision .. Termination Due to Retrenchment - Lawyers in the Philippines. Retrenchment, as defined by the Supreme Court, is: … an act of the employer of dismissing employees because of losses in the operation of a business, lack of work, and considerable reduction on the volume of his business, a right consistently recognized and affirmed by this Court. [ G.R. 181719, Apr 2014]. Retrenchment and tax: all you need to know - Sanlam Reality. 18% of taxable income above R500 000. R700 001 – R1 050 000. R36 000 + 27% of taxable income above R700 000. R1 050 001 and above retrenchment package calculator. R130 500 + 36% of taxable income above R1 050 000. Source: TaxTim, correct as at 24 June 2022az év madara 2013 gyurgyalag syair hk 14 maret 2023

. It’s important to remember that everyone has a lifetime tax relief of R500 000. So, whether you hit this …. Retrenchment Requirements In South Africa - 2024/2025. Severance pay – this should be at least one week’s remuneration per completed year of service. Remuneration is calculated including basic salary and payments in kind. Outstanding leave must be paid out in full. Notice pay may vary depending on your employment contract. Retrenchment Requirements In South Africa. retrenchment package calculator. How to Calculate Severance Pay: A Step-by-Step Guide - wikiHow. Accordingly, you would divide your yearly salary by 52 to get the weekly pay rate. Then, multiply this pay rate by the number of weeks. If you earn $39,000 a year, then you make $750 a weektələbə qəbulu üzrə dövlət komissiyası cfare eshte parashkrimi

. If you worked for the company for 10 years, then you would get $7,500 in severance. 2.. What the law says about severance pay in South Africa. Under South Africa’s Basic Conditions of Employment Act (BCEA), specifically section 41 (1), a retrenched employee is entitled to severance pay equivalent to at least one week’s remuneration . retrenchment package calculator.